Market Research on Corn Flour and Corn Grits in Myanmar: 10-Year Outlook & Investment Returns

- Jane Liu

- Sep 5

- 3 min read

I. Current Market Status & Usage Analysis

Corn Resources and Processing Foundation

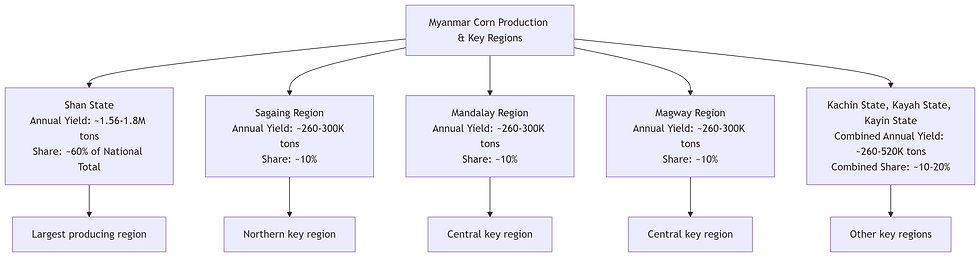

Myanmar is a major corn producer in Southeast Asia, with an annual output of approximately 3.2 million tons in 2024. Two-thirds (around 2.2 million tons) are exported as raw materials, while the remaining 1 million tons are for domestic consumption. Currently, domestic corn processing focuses on primary products, with 90% of corn exported in raw form and deep processing rates below 10%. Products like corn flour and grits rely heavily on import substitution.

Core Applications and Consumption Scenarios

Food Processing: Corn grits are a key ingredient in "Mohinga" (Myanmar’s national fish noodle soup), and corn flour is used in pastries, fried snacks, and infant food, accounting for 40% of domestic consumption.

Feed Production: Corn flour is added as an energy feed in livestock farming, representing 55% of domestic use, with annual demand growing at 5% due to scaling up.

Industrial Use: The medium- to long-term recovery trend in beer/beverage consumption is used as a reference for the optimistic scenario of grits (for brewing) demandMinimal applications in starch/ethanol production (less than 5% of consumption), indicating untapped potential.

Competitive Landscape

The market is dominated by small local mills with homogeneous, low-standard products. Imported goods (primarily from Thailand and China) dominate the mid-to-high-end segment—for example, Thai corn flour is priced 1.5x higher than local products in Yangon supermarkets.

II. 10-Year Market Outlook (2025–2035)

Demand Growth Drivers

Population and Economic Fundamentals: Myanmar’s population is projected to reach 58 million by 2035. Urbanization will boost food industry demand, with per capita corn flour consumption rising from 2.3kg/year to 3.5kg/year.

Policy Support: The government’s "Golden Corn Value Chain" initiative allocates 50 billion kyats (~$17 million) to support deep processing, offering 5-year tax exemptions and 50% import duty reductions on equipment. The goal is to replace 30% of imported feed raw materials.

Industrial Chain Upgrades: Chinese agribusinesses (e.g., New Hope Group, Zhengbang Agriculture) are expanding Myanmar’s livestock sector, driving feed-grade corn flour demand to exceed 800,000 tons by 2030.

Risks and Challenges

Infrastructure Gaps: Only 30% of roads are paved, with logistics costs accounting for 25% of processors’ total costs (vs. 8% for Chinese peers).

Political and Currency Volatility: Post-2021 coup, foreign investment has plummeted, and the kyat has depreciated 40% against the USD in three years, inflating import costs.

International Competition: Thailand’s mature corn processing industry (65% deep processing rate) and duty-free exports dominate Myanmar’s high-end market.

III. Investment Return Analysis

Cost-Benefit Estimation (10,000-ton/year corn flour plant)

Initial Investment: ~$2 million (equipment, factory, working capital), with 30% of equipment costs subsidized by government grants.

Operating Costs: Raw corn ($260/ton) + processing ($80/ton) = ~$340/ton total.

Revenue: Domestic selling price $450–500/ton, gross margin ~30%, static payback period 5–6 years.

Value-Added Potential

Product Upgrades: Organic corn flour or pregelatinized starch can command 50%+ price premiums.

Export Opportunities: Leveraging ASEAN tariff exemptions to export corn grits to Bangladesh/India at FOB prices of $280/ton (vs. raw corn export prices of $255–265/ton).

IV. Strategic Recommendations

Short-Term (1–3 years):

Locate plants near Mandalay or Yangon to access corn-producing regions and consumer markets, reducing logistics costs.

Prioritize feed-grade corn flour production and secure long-term contracts with Chinese livestock firms.

Mid-to-Long-Term (5–10 years):

Adopt Chinese low-temperature milling technology to retain >85% protein content, targeting premium food markets.

Participate in government PPP projects to build integrated corn-feed-livestock chains, accessing tax breaks and export quotas.

Risk Mitigation:

Use USD settlements to lock in raw material costs and utilize cross-border RMB payment channels to hedge currency volatility.

Conclusion

Myanmar’s corn flour and grits market is at a critical juncture of supply-demand mismatch and policy dividends. Demand is projected to grow 6–8% annually over the next decade. Investors should prioritize localized production, leverage policy subsidies, and focus initially on feed and traditional food sectors, gradually expanding into high-value products and exports for stable long-term returns.

(Note: Data sourced from Myanmar’s Ministry of Commerce, World Bank reports, and industry. Investment decisions should be validated through on-site due diligence.)

Contact

Jane:+139 3305 7265

Comments